Exploring e-Residency: statistics and insights

E-residency, Estonia’s pioneering digital identity program, continues to thrive and expand, empowering global entrepreneurs and professionals with borderless business opportunities. Let’s delve into the latest statistics that highlight the growth and impact of e-residency on international entrepreneurship.

Total number of e-Residents

As of the most recent data, the total number of e-residents of Estonia has surpassed 112,700, reflecting a substantial increase in adoption and interest from individuals worldwide.

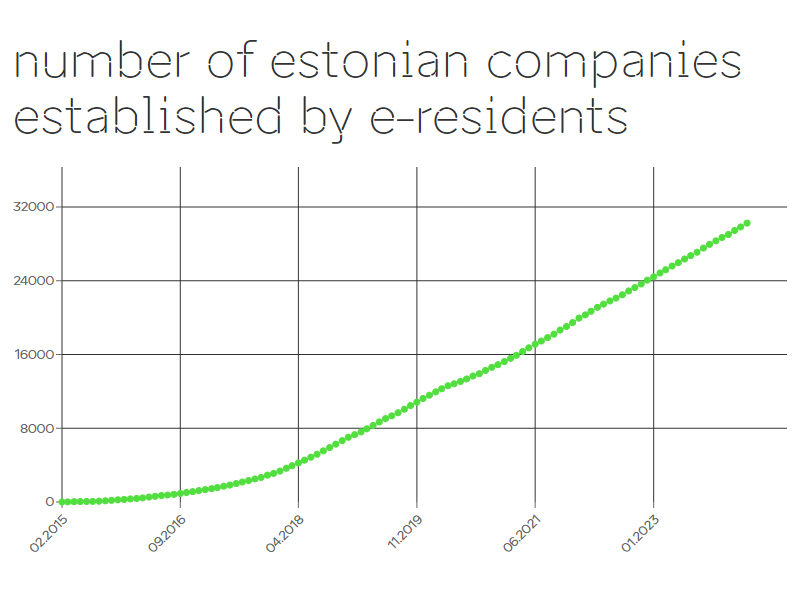

Estonian companies established by e-Residents

E-residents have leveraged this digital platform to establish over 30,200 Estonian companies, showcasing the program’s effectiveness in facilitating remote business setup and management.

New applications in March 2024

In March 2024 alone, there were 1,077 new applications for e-residency, underscoring sustained demand and growth in the program.

New Estonian companies established in March 2024

During the same period, e-residents established 419 new Estonian companies, demonstrating ongoing entrepreneurial activity and investment through e-residency.

Global service providers on e-Residency marketplace

The E-Residency Marketplace offers access to over 140 global service providers, enabling e-residents to access a comprehensive range of business support services conveniently.

Entrepreneurs choose Estonia for tax deferral benefits

Although the corporate income tax rate in Estonia is 20%, the Estonian tax system allows startups to thrive because income tax is only paid when dividends are distributed. Many startups do not pay dividends for many years, resulting in a 0% corporate income tax rate. This enables them to accumulate capital for development, and only later share profits or sell shares to foreign investors. This is a benefit of the Estonian tax system that attracts startups like Skype, Microsoft, Bolt, and others.

E-Resident companies set tax revenue record in 2023

In 2023, Estonian companies owned by e-residents contributed a record €64.3 million in tax revenue to the state treasury, marking a 33% increase compared to the previous year. The majority of tax revenue for 2023, accounting for 63% or €40.7 million, was derived from labor taxes. The remaining 37% of tax revenue, totaling €23.6 million, was generated from special case income tax, primarily from dividends paid by Estonian companies owned by e-residents. The cumulative direct economic impact of the e-residency program on Estonia, encompassing labor and dividend taxes along with state fees, has reached €213 million to date.

Geographic distribution of e-Residents

The majority of e-residents hail from various countries, with the largest numbers coming from Ukraine (7,050), Germany (6,743), Finland (6,186), and Spain (6,116), highlighting the program’s diverse international reach.

E-Resident companies by citizenship

In terms of e-resident company ownership, Spain leads with 2,516 companies, followed closely by Ukraine with 2,410 companies and Germany with 2,345 companies, demonstrating a robust entrepreneurial presence across multiple nationalities.

E-Resident companies by citizenship outside Europe

Outside of Europe, significant numbers of e-resident companies are owned by individuals from:

- India: 950 companies

- United States: 688 companies

- China: 501 companies

- Japan: 421 companies

These figures highlight the global appeal of e-residency and its role in fostering international business partnerships beyond European borders. By facilitating seamless access to the European market and digital services, e-residency continues to empower entrepreneurs from diverse regions to participate in the global economy and drive innovation on a transcontinental scale.

Top 7 fields of activity of Estonian companies established by e-Residents

- Computer programming, consultancy, and related activities: 8,126 companies

- Activities of head offices, management consultancy activities: 5,191 companies

- Retail trade, except of motor vehicles and motorcycles: 2,862 companies

- Information service activities: 1,833 companies

- Wholesale trade, except of motor vehicles and motorcycles: 1,597 companies

- Publishing activities: 1,481 companies

- Financial service activities, except insurance and pension funding: 1,339 companies

These statistics underscore the tangible impact of e-residency on fostering global entrepreneurship and facilitating cross-border business activities. As e-residency continues to evolve and attract a diverse community of innovators and professionals, Estonia’s digital ecosystem remains at the forefront of digital governance and international business facilitation. The numbers speak volumes about the transformative potential of e-residency in reshaping traditional paradigms of entrepreneurship and economic engagement on a global scale.

Check out how to become an e-resident – https://www.e-resident.gov.ee/become-an-e-resident/

How to start a company in Estonia – https://www.e-resident.gov.ee/start-a-company/

How to run your company accounting as an e-resident – https://www.simplbooks.ee/en/

Try SimplBooks accounting software!

A more advanced and easy accounting software SimplBooks with over 10,000 active users – register an account and you can try 30 days free of charge and risk-free (no financial obligations shall arise). Or try our demo version!

Leave a Reply