Calculation of holiday pay in Estonia (5)

The holiday pay must be paid to the employee no later than on the penultimate working day before the start of the holiday. By mutual agreement of the parties, the holiday pay may also be paid to the employee on the next pay day, but since then the payment of the holiday pay is no longer permitted. In addition to the annual leave, the leave may also be additional leave, study leave or parental leave.

How to calculate holiday pay?

Holiday pay is calculated on the basis of the employee’s earnings during the six previous months. To be able to take leave with full holiday pay, the employee must have worked in the company for at least 6 months. In the case of holiday pay, days when the employee did not work for a good reason, was ill or on holiday, and public holidays are not taken into account. The amount of holiday pay is obtained by taking 6 monthly salaries and the number of 6-month calendar days, then dividing the amount of pay by the number of calendar days and getting the average calendar day pay, which in turn is multiplied by the number of calendar days of vacation. If the employee was paid a fixed salary during the six months or less than six months preceding the month in which the holiday pay is calculated, the average daily calendar pay is not calculated, and the employee shall be paid a fixed salary as a holiday pay.

Simple example

The employee’s leave lasts between 07.06. 2021 – 20.06.2021 (2 weeks). The employee has worked in the company for more than six months and the gross salaries for the last six months totalled 10,200 euros. During the last six months, the employee had a sick leave from 01.03 to 05.03, i.e. 5 calendar days. We take 10,200 euros (6-month gross salary) and calculate for 182 days (6-month calendar days from December to May, because the holiday starts in June). Within this period, there were also 6 public holidays. Thus, the calculation of the remuneration for one holiday day is as follows: 10,200 / (182 – 5 – 6) = 59.65 €. If the employee is on holiday for 2 weeks, then we can calculate the total holiday pay as follows: 59.65 € x 14 = 835.1 € (gross).

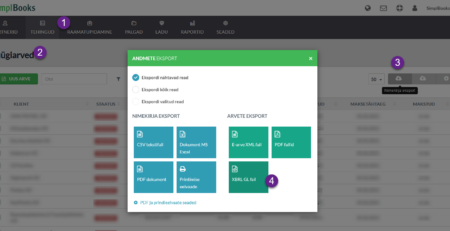

See also the SimplBooks guide “How to calculate employee’s holiday pay in SimplBooks”.

Comments (5)

Hello, so the employee receives the normal salary while on vacation, plus the vacation pay, right?

Hello!

Sorry for the late answer. No, the employee receives only the vacation pay, which will replace the salary for this period.

I’m quite shocked Estonian labor law doesn’t actually give employees vacation pay ON TOP of normal salary. Because now these vacation days are effectively unpaid vacations. In Finland you get your normal salary and then vacation pay on top and I’m sure most countries operate like this.

Hello,

If 14 consecutive days are mandatory and it has 2 Weekends, those weekend are also included or how ?

Hello Nick!

Yes, those weekends are also included.